Heading off to college is a massive life change, and it’s about a lot more than just what happens in the classroom. For many, it’s the first real taste of independence—and that includes handling your own money. Getting a handle on financial planning for college students isn't just about spreadsheets; it’s tied directly to your motivation, your mental health, and the people you have in your corner.

When you’re stressed about finances, it’s easy to let assignments slide or just feel completely overwhelmed. That's why it's so important to look at the whole picture.

This whole process really starts before the first tuition bill ever shows up. It kicks off with honest, open conversations between students and parents—no judgment allowed. These talks need to cover expectations, who’s responsible for what, and the very real mental pressures that come with this new chapter. For young men especially, who often feel this unspoken pressure to have it all figured out, finding a supportive community is huge. Men's groups and other organizations focused on young men's mental health can be a lifeline, offering a place to navigate these challenges without feeling like you're on an island.

The Parental Role in Building Financial and Mental Resilience

Parents have a huge part to play in getting their teens ready for the financial side of college. But this support is about more than just writing checks. It’s about coaching them to build real confidence and skills.

- Make Money a Normal Conversation: Create a safe space where money can be discussed without any shame. Talk about what your family values when it comes to spending and saving.

- Lead by Example: Let your teen see you making a budget, planning for a big purchase, or talking through financial decisions. It’s a powerful, real-world lesson they can’t get in a classroom.

- Connect the Dots: Help them see how their motivation in school links up with their future career goals and, ultimately, their financial freedom. This can be a game-changer for beating procrastination.

This kind of proactive planning is thankfully becoming more common. New research shows that about half of all families with college-bound kids are actively saving, and a solid 53% have a clear strategy for how to pay for it all. This often looks like a team effort, with 30% of families mapping out exactly what parents will contribute and 20% outlining what the student is expected to cover. These numbers show a clear shift toward families tackling this together.

Equipping Teens with Skills That Actually Matter

Being financially literate is just one piece of the puzzle. To really thrive, students also need to get good at managing their time, handling their emotions, and speaking up for themselves.

Learning how to deal with procrastination and school-related anxiety head-on is a huge part of the prep work. Honestly, figuring out how to manage those challenges is just as important as knowing how to manage a bank account. For a deeper look, check out our guide on essential life skills for high school students.

A simple but incredibly effective way to handle stress and stay on track is meditation. For teens getting crushed by the pressure of school and money, even a short, guided meditation can be a total game-changer. It helps clear your head, cuts down on anxiety, and sharpens your focus, making it easier to tackle both a tough exam and a tricky budget.

By paying attention to the mental and emotional side of this journey, we’re setting the stage for real financial empowerment. The goal isn’t just to get through college without going broke—it’s to build habits and a kind of resilience that will stick with you for life.

Navigating Financial Aid and Scholarships

Financial aid can feel like a maze, but it’s one of the most powerful tools you have when planning for college. This isn't just about filling out forms; it’s about understanding the system to unlock the funding you need. It all starts with one key document: the FAFSA.

The FAFSA (Free Application for Federal Student Aid) is your gateway to federal grants, loans, and work-study programs. It's also the form most states and colleges use to determine their own aid awards. If you want to be considered for almost any kind of financial aid, submitting it is non-negotiable.

The numbers don't lie. In 2025, the average undergraduate student received $16,360 in aid. Of that, a solid $11,610 came from grants—money you never have to pay back. Yet, shockingly, only about 43% of the class of 2024 even submitted a FAFSA, leaving billions of dollars on the table. Bankrate.com has some great insights on these FAFSA statistics if you want to dig deeper.

The Mental and Emotional Side of Financial Aid

Let’s be real: for many students, especially teen boys who often feel pressured to figure things out on their own, the financial aid process is a huge source of stress. That anxiety can lead to procrastination, which is the easiest way to miss critical deadlines. The key is to approach it with a clear head and a solid support system.

A simple meditation practice can be a game-changer here. Just taking five minutes to focus on your breath can quiet the mental noise and make everything feel less overwhelming. This isn't just about feeling calm; it's about sharpening your focus so you can actually tackle complex tasks like scholarship applications.

If you’re struggling, remember you don’t have to go it alone. Most campuses have mental health services, and organizations like Next Gen Men or The Jed Foundation offer specific support for young men navigating the pressures of school and life. For a deeper look at getting ready for this journey, check out our guide on college planning for high school students.

Smart Strategies for Parents

Parents, your role here is vital. Think of yourself as a coach and collaborator, not just a manager. Your support can make a massive difference in both the financial outcome and your teen's well-being.

- Be a Partner, Not a Director: Work with your student to gather the documents you'll need (like tax returns and bank statements). Sharing this responsibility teaches them invaluable life skills.

- Frame it as a Project: Break the application process down into small, manageable tasks with clear deadlines. This approach is a powerful antidote to procrastination and makes the whole thing feel less daunting.

- Keep Communication Open: Talk honestly about the financial realities and what the family can contribute. A non-judgmental conversation can relieve a student's anxiety about feeling like a financial burden.

Remember, the goal isn’t just to secure aid. It's to empower your student with the confidence to manage their finances. This collaborative effort builds a foundation of financial literacy that will serve them long after they graduate.

Looking Beyond the FAFSA at Scholarships and Grants

Federal aid is just the starting point. The world of scholarships and grants is huge, offering money for everything from academic merit and athletic talent to unique hobbies and community service.

Finding these opportunities takes some proactive effort. Don't just focus on the big, national scholarships. Local community foundations, rotary clubs, and even your parents' employers are often overlooked sources of funding with way less competition.

When you're writing those application essays, be authentic. Tell your story. Connect your experiences to your future goals—that’s far more compelling than a generic, cookie-cutter response. Finally, when those award letters come in, read them carefully. Pay close attention to the difference between "gift aid" (grants and scholarships) and loans, which you have to repay with interest. Understanding that distinction is critical to making an informed decision about your financial future.

Smart Saving Strategies for College Students

Let's be real—saving money in college feels like a tall order. Between textbooks, late-night pizza runs, and just trying to have a social life, setting money aside can seem impossible. But building a savings habit now isn’t about depriving yourself; it’s one of the most powerful moves you can make for your future. It's about building a foundation for financial freedom that will last long after you’ve tossed your graduation cap. It all starts with a simple shift in how you see your money.

The secret weapon here is the "pay yourself first" method. Before you spend a dime on anything else—snacks, subscriptions, concert tickets—you move a set amount of cash from your checking account straight into savings. Seriously, even if it's just $10 or $20 a week, you’d be amazed at how quickly it adds up.

This isn’t just about hoarding cash. It's about making your future self a priority. It builds the kind of financial discipline that will serve you for decades and makes saving a non-negotiable part of your routine.

Automate Your Savings for Effortless Growth

The best way to stick to the "pay yourself first" rule? Make it automatic. Head to your banking app right now and set up a recurring transfer from your checking to your savings account. When that money moves on its own, you’ll barely even notice it’s gone, but your savings account will keep growing in the background.

This one small move is a game-changer for beating procrastination and easing financial anxiety. Instead of stressing about if you can save, you just are saving.

The power of starting early is almost unbelievable. Just look at the research on college savings plans: starting at birth with a $250 monthly contribution could swell to over $104,000 by age 18, all thanks to compounding interest. But if you wait until age 12 to start those same contributions, you end up with only about $20,896. That massive difference shows exactly why starting now, even with small amounts, is so critical. You can dive deeper into these numbers by exploring more findings about early financial planning.

Supporting Your Student From Home: Parenting Tips

For parents, the goal is to be a guide, not a micromanager. Your child's ability to handle money is tied directly to their motivation and overall well-being.

- Encourage Separate Accounts: Help them open different savings accounts for specific goals. Having a "Spring Break Fund," an "Emergency Fund," and a "Post-Grad Apartment Fund" makes saving feel more real and a lot less overwhelming.

- Discuss High-Yield Options: This is a great time to introduce them to high-yield savings accounts (HYSAs). These accounts offer way better interest rates than the standard savings account, letting their money actually work for them. It’s a perfect first lesson in passive income.

- Celebrate the Small Wins: Acknowledge their progress. When they hit a savings goal or handle an unexpected car repair with their own emergency fund, celebrate it! Positive reinforcement goes a long way in building confidence.

Financial worries are a huge trigger for procrastination and anxiety in school. A key part of financial well-being is managing that stress. Creating a simple, structured savings plan is a practical way to get back a sense of control.

Resources for Mental Health and Motivation

Financial stress can be isolating, especially for young men who often feel the pressure to figure everything out on their own. It's crucial to know that resources are out there.

Organizations like The Man Cave and HeadsUpGuys offer communities and tools specifically for young men navigating mental health challenges. These groups are safe spaces to talk about stress, motivation, and the pressures of school without fear of judgment.

On top of that, a simple meditation practice can be a surprisingly powerful tool. Just a few minutes of guided meditation each day can help calm an anxious mind, sharpen your focus, and make financial tasks feel less like a chore. This is about building resilience from the inside out, giving you the mental clarity to stay on top of both your studies and your finances.

Managing Student Loans and Credit Cards Wisely

Let’s talk about debt. For a lot of students, that word is a source of major stress. But I want you to start thinking about debt as a tool—not something to be afraid of.

When you manage them right, student loans and credit cards can unlock your education and help you build a solid financial foundation. The secret is to understand exactly how they work and to be smart about them from day one. This isn't about avoiding debt entirely; it's about building a healthy, confident relationship with credit right from the start.

Understanding the Different Types of Student Loans

Not all student loans are the same. Not even close. The two big categories are federal loans (from the government) and private loans (from banks, credit unions, etc.). My advice? Always, always, always look at your federal loan options first. They almost always come with better protections and more flexible ways to pay them back.

Here’s a quick rundown of what you’ll likely see:

- Subsidized Federal Loans: These are the best deal you can get. They're based on financial need, and the government pays the interest while you're in school at least half-time. That’s a huge win because your loan balance isn’t growing while you’re focused on classes.

- Unsubsidized Federal Loans: These aren't based on need, which means pretty much anyone can get them. The catch? Interest starts piling up the second the money is sent out. You are on the hook for all of it, which can seriously inflate your total debt if you're not paying that interest down.

- PLUS Loans: These are federal loans for grad students or parents of undergrads. The interest rates are typically a bit higher than the other federal loans.

- Private Loans: These should be your absolute last resort—after you've maxed out all federal aid, scholarships, and grants. Private loans almost always require a credit check (and often a co-signer), can have variable interest rates that change over time, and offer far fewer safety nets if you run into trouble.

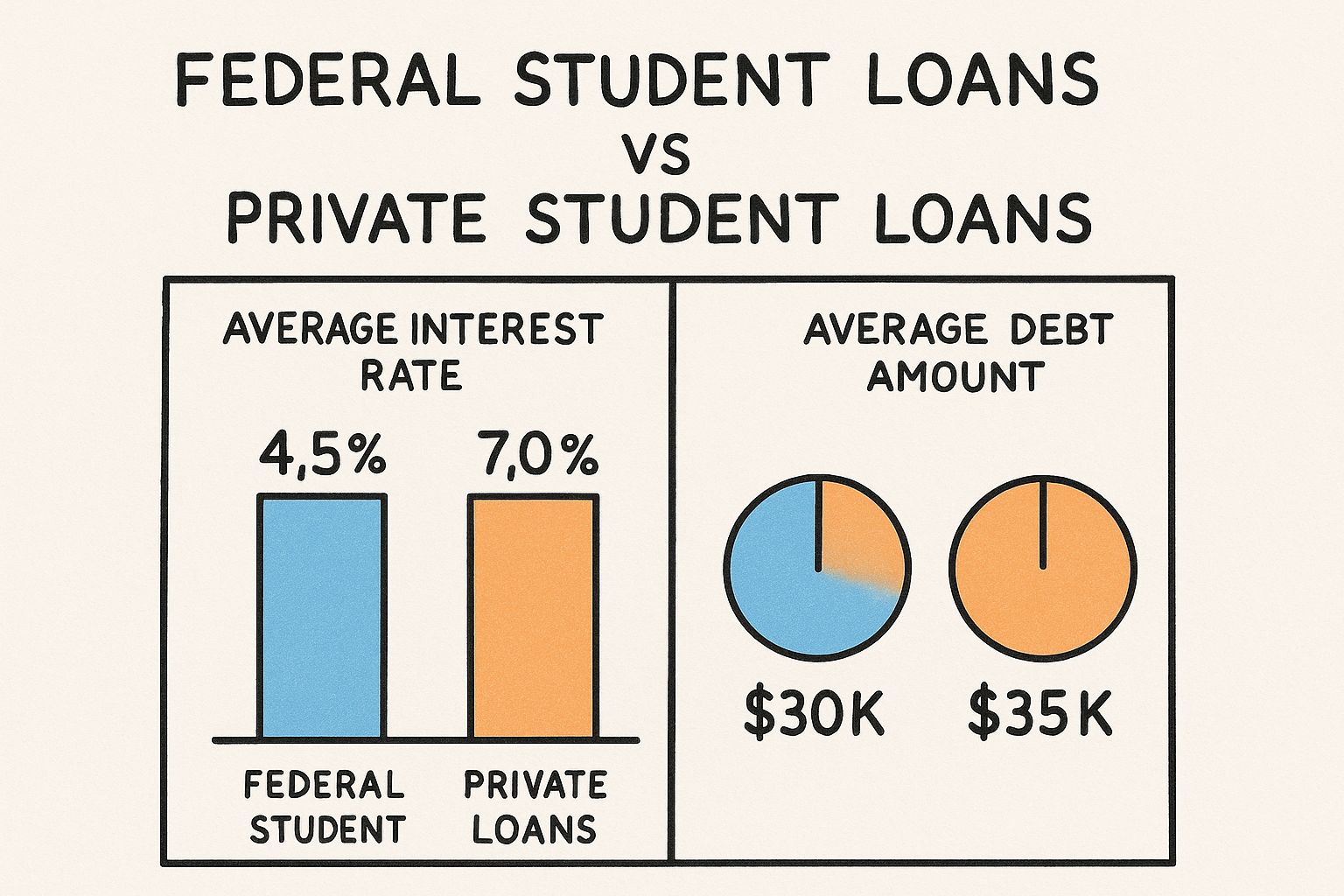

Take a look at this infographic. It really breaks down the key differences between your main loan options.

As you can see, federal loans are designed to be more borrower-friendly, making them the safer bet for most students.

To make this even clearer, here's a side-by-side comparison of the two main loan types.

Federal vs Private Student Loans at a Glance

Navigating student loans can feel overwhelming, but understanding the core differences between federal and private options is the first step toward making a smart borrowing decision. The table below breaks down the most important features to consider.

| Feature | Federal Student Loans | Private Student Loans |

|---|---|---|

| Source | U.S. Department of Education | Banks, credit unions, online lenders |

| Interest Rates | Fixed and often lower | Can be fixed or variable; often higher |

| Borrower Protections | Income-driven repayment, deferment, forbearance | Very limited; varies by lender |

| Credit Check | Not required for most undergraduate loans | Almost always required; co-signer often needed |

| Loan Forgiveness | Available (e.g., Public Service Loan Forgiveness) | Extremely rare |

Ultimately, federal loans provide a crucial safety net that private loans just don't offer. Always start there.

Building a Positive Credit History with Your First Credit Card

A credit card can be an incredible tool for building a good credit history, which you'll need for things like renting an apartment, buying a car, or even passing a background check for a job. But this tool requires discipline.

Start by choosing the right card. Look for a student card with no annual fee and a low credit limit to keep you from getting in over your head.

Now for the golden rule: Pay your balance in full and on time. Every. Single. Month. High-interest credit card debt is a trap that can derail your financial goals faster than anything else. My best advice? Treat your credit card like a debit card—only charge what you already have in the bank to pay it off.

Managing your first credit card is more than a financial task; it's a test of self-discipline. Resisting the temptation to overspend builds a habit of mindful consumption, a skill that is foundational to long-term financial stability and mental peace.

Don't forget to look beyond just paying things back. After graduation, there are even some grants available to help pay off student loans, which can give you a massive head start.

Parenting Tips for Guiding Young Adults with Debt

Parents, you have a huge role to play here. Your guidance can help your student avoid some expensive mistakes and ease the anxiety that comes with borrowing money.

- Co-Sign with Caution: Before you co-sign a private loan or credit card, have a very direct conversation about who is responsible for payments. Make sure they understand that your credit score is on the line, too.

- Teach Interest Capitalization: This is a game-changer. Explain how unpaid interest on unsubsidized loans gets tacked onto the principal (capitalization). This means they end up paying interest on top of their interest. It’s a powerful, real-world example of how debt can snowball.

- Promote Open Dialogue: Make it clear that they can talk to you about money struggles without being judged. This is especially important for young men, who often feel pressure to figure it all out on their own and stay silent when they're stressed.

Mental Health, Motivation, and Financial Stress

Let’s be real: worrying about money is a leading cause of stress and anxiety for college students. When you feel buried under loan balances or credit card bills, it’s easy to lose motivation for everything else, including your schoolwork.

It's so important to connect with resources that can help. For teen boys and young men who feel like they're carrying this weight alone, organizations like The Mankind Project or other local men's groups can offer a community of support to navigate these pressures.

On a personal level, a simple meditation practice can be a surprisingly powerful tool. Just a few minutes of guided meditation can quiet the financial anxiety, sharpen your focus, and give you the mental space to tackle your budget and your studies. This is about building resilience from the inside out.

Boosting Your Income Without Sacrificing Your Grades

Juggling work and school is a classic college balancing act, but making extra money doesn't have to tank your GPA. The secret is to work smarter, not just harder. Forget the rigid, low-wage campus job—it's time to start thinking about flexible side hustles that fit your schedule and use the skills you already have. This isn't just about making money; it's about making your college experience richer, not letting a job detract from it.

This requires a different mindset. Instead of just trading hours for dollars in a role you don't care about, you can monetize your talents on your own terms. Whether you're a gifted writer, a design whiz, or just incredibly organized, there's a market for what you can do.

Turn Your Skills Into Flexible Income

Take a minute and think about what you're already good at. Are you the friend everyone asks to proofread their essays? Do you have an eye for design or a knack for explaining tough concepts in a way that just clicks? These aren't just hobbies; they're marketable skills.

Here are a few ideas to get the wheels turning:

- Freelance Writing or Editing: Platforms like Upwork or Fiverr can connect you with clients who need blog posts, articles, or editing work done. You can take on projects that fit your schedule, working from your dorm room right between classes.

- Tutoring: If you're acing a particular subject, offer to help fellow students or even local high schoolers. Not only does this pay well, but it forces you to master the material on a deeper level.

- Graphic Design: Tons of small businesses and campus clubs need logos, social media graphics, or event flyers. If you're handy with tools like Canva or the Adobe Creative Suite, you can build a solid portfolio while earning cash.

- Virtual Assistant (VA): A VA handles administrative tasks—like managing emails, scheduling, and social media posts—for busy professionals. It's the perfect remote gig if you're organized and detail-oriented.

The real win with a side hustle in college isn't just the money. It's about building professional experience, developing new skills, and making connections that can open doors for you after graduation.

This kind of proactive approach to work is also a massive step in your professional development. In fact, dipping your toes into these roles can give you real-world insights into your future, a crucial part of your overall career planning for college students.

The Mental Game of Juggling It All

Let's be real: juggling classes, homework, a social life, and a job can be a fast track to burnout if you aren't careful. Financial stress is a huge trigger for anxiety and procrastination, and piling a job on top can amplify that pressure. This is especially true for young men, who often feel this unspoken pressure to have it all figured out on their own without showing any sign of struggle.

It’s so important to have support systems in place. You're not supposed to do this alone. Resources like The Jed Foundation offer incredible mental health support for teens and young adults, while groups like The Man Cave provide a space for young men to connect and talk openly about the pressures they're facing.

Even a simple meditation practice can be a game-changer for managing this stress. Just five to ten minutes of guided meditation each day can help clear your head, dial down the anxiety, and sharpen your focus. That mental clarity is everything when you're trying to stay motivated and avoid the procrastination trap that comes when you feel overwhelmed.

A Few Tips for Parents Supporting a Working Student

Parents, your support here is key. You can help your student navigate this new chapter without them sacrificing their well-being.

- Encourage Good Time Management: Help them use a planner or a digital calendar to block out time for classes, studying, work, and just being a person. Seeing it all laid out can make a packed schedule feel way more manageable and help keep burnout at bay.

- Focus on the 'Why': Connect their work to their bigger goals. Remind them that the skills they’re building now—whether it's time management from juggling deadlines or actual design skills—are valuable assets for their future career.

- Keep the Lines of Communication Open: Create a judgment-free zone where they can be honest about feeling stressed or overwhelmed. Sometimes, just knowing they have someone to listen is the most valuable support you can offer.

The Invisible Weight: Managing Financial Stress and Mental Health

Let’s be real: money stress is one of the biggest, yet most invisible, challenges of college life.

Worrying about tuition, rent, or how you’re going to afford groceries can take a massive toll on your mental health. That stress doesn't just stay in your bank account; it spills over into your motivation and tanks your academic performance. That's why smart financial planning isn't just about crunching numbers—it’s about building the resilience to handle the anxiety that always seems to come with money.

When you're completely overwhelmed by financial pressure, it's natural to push important tasks aside. Procrastinating on that scholarship application or avoiding your budget isn't laziness. It's a totally normal response to feeling stressed and out of control. The trick is to tackle both the money issue and the emotional spiral it triggers.

The Crucial Link Between Money and Mind

You can't separate your bank account from your mental state—they’re deeply connected. A staggering 90 percent of students on Pell Grants still can't cover all their costs, often falling thousands of dollars short every single year. Living with that kind of constant pressure creates a nasty cycle of anxiety that makes it almost impossible to focus on your studies.

Just recognizing this link is the first real step toward taking back control. When you feel that familiar dread creeping in about checking your balance, see it as a signal. It's time to pause and check in with your mental state first.

Financial well-being and mental well-being are two sides of the same coin. You can't effectively manage one without paying attention to the other. Creating small, manageable financial habits is a powerful way to reduce anxiety and build a sense of agency over your life.

Practical Steps to Calm a Worried Mind

Managing money stress means having tools for both your budget and your brain. When you feel that wave of overwhelm, simple mindfulness techniques can make a world of difference. They help you hit the reset button so you can approach problems with a clearer head.

A short, guided meditation can be an incredibly powerful tool. You don't need any fancy equipment or a lot of time—just a quiet spot to focus on your breath.

A Simple Meditation Guide for Teens

- Find a Comfortable Spot: Sit upright in a chair with your feet flat on the floor, or find a cushion on the ground. Let your hands rest gently in your lap.

- Close Your Eyes: Gently close your eyes, or just soften your gaze and look at the floor in front of you.

- Focus on Your Breath: Tune into the physical sensation of your breath. Notice the air coming in through your nose, filling your lungs, and then leaving your body. That's it.

- Acknowledge Wandering Thoughts: Your mind will wander. That’s what minds do. When you notice your thoughts drifting to your to-do list or money worries, just gently notice them without judgment and bring your focus back to your breath.

- Start Small: Just aim for three to five minutes. Consistency is way more important than how long you do it. A few minutes every day can seriously reduce anxiety and sharpen your focus.

Essential Resources and Support Systems

You were never meant to figure all this out alone. Asking for help is a sign of strength, and there are so many resources out there designed to support you. Beyond just getting your finances stable, taking care of your mental health is what will ultimately lead to success. You can find essential mental health resources to support your well-being during what can be a really stressful time.

This is especially true for young men, who often feel this intense pressure to handle everything silently. Finding a community where you can be real is vital. Organizations like The Mankind Project or HeadsUpGuys offer safe spaces to talk about the unique pressures young men face with school, money, and mental health. These groups help break down the stigma and give you practical tools for building emotional resilience.

Parenting Tips for Supportive Conversations

Parents, you play a huge role here. Your goal is to be a supportive coach, not another source of pressure.

- Foster Open Dialogue: Create a judgment-free zone where your son or daughter can talk openly about money fears without getting a lecture. A simple, "Let's figure this out together," goes a long way.

- Validate Their Stress: College is hard. Managing money for the first time is hard. Acknowledging that with a simple, "I get why you're feeling stressed about this," can ease their anxiety and make them more open to your help.

- Focus on Solutions, Not Problems: When they come to you with a financial issue, team up to brainstorm solutions. This approach empowers them to become proactive problem-solvers instead of feeling helpless.

By combining practical money strategies with dedicated mental health support, you're not just getting through college—you're building a foundation for a lifetime of well-being.

At Andrew Petrillo Life Coaching, we specialize in helping teens and young adults build the skills they need to thrive in school and beyond. From managing academic pressure to developing resilience, our personalized coaching provides the tools for lasting success. Learn more about how we can support your journey at https://andrewpetrillolifecoaching.com.